Key findings

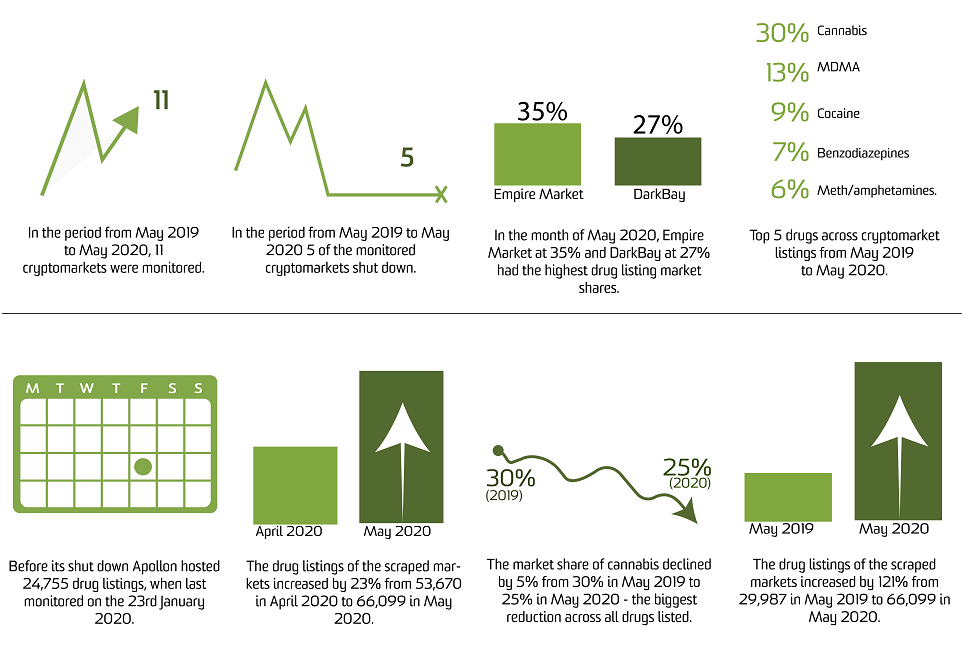

- From 1 May 2019 to 31 May 2020, 11 cryptomarkets were monitored; five of these markets closed during this period.

- May 2020 saw a weekly average of 66,099 drug listings, with a 23% increase from 53,670 average weekly listings in April 2020.

- In comparison to the last year, May 2020 had a 121% increase from 29,897 average weekly listings in May 2019. This reflects a general increase in listings since closure of a major marketplace (Dream Market) in March 2019.

- Empire Market had the largest share of drug listings across all markets, hosting 35% of drug listings in the month of May 2020, followed by Dark Bay (27%).

- Cannabis (30%), MDMA (13%), cocaine (8.5%), benzodiazepines (7.0%) and meth/amphetamine (6.2%) were the five drugs accounting for the greatest percentage of average listings during the May 2019 to May 2020 period.

- The market share of cannabis declined from 30% in May 2019 to 25% in May 2020, while the market share of cocaine increased from 7.6% in May 2019 to 9.9% in May 2020.

Background

This bulletin series reports on trends in the availability and type of substances sold on the internet via cryptomarkets over the last 13 months (a new bulletin is released typically every four months). The current bulletin focuses on analysis of listings from 1 May 2019 to 31 May 2020.

Drug Trends has identified, crawled (or ‘scraped’) , extracted, categorised and analysed drug listings on cryptomarkets on a weekly basis since 1 January 2014, formerly using VBA programming processes, and since 9 August 2018 using a range of programmed automated processes in Python that operate with minimal manual input. Further background and information regarding the methods are available for download.

Panel A. Terminology

Cryptomarkets (‘darknet markets’) are anonymous online trading platforms that facilitate the purchasing of illicit goods and services via multiple sellers.

Number of listings is the sum of listings per single scrape each week belonging to a specific market and/or drug category. For this measure, duplicate listings (defined as listings with identical names and same quantity of drug by a single vendor on a single market) within the same week are removed.

Number of vendors is the sum of unique vendors per single scrape each week selling a specific drug category within each market. For this measure, a vendor is considered unique only within the same market; that is, the same vendor may be counted multiple times across different markets. Please note that the number of vendors is not summed across different markets in our visualisation and bulletin.

Our reporting focuses only on identified English-language cryptomarkets selling drugs which have ≥100 drug listings and ≥1 vendor. For a historical record of marketplaces monitored by DNeT, we refer the reader to our interactive timeline.

Analyses are concentrated on listings on these marketplaces advertising the sale of illicit drugs (e.g., heroin), key licit drugs (e.g., alcohol, tobacco, e-cigarettes) and pharmaceutical medicines, as well as drug-related paraphernalia (e.g., needles and syringes, colorimetric reagent kits).

Following extraction of common text features across each listing (e.g., drug listing name, vendor name and the price in bitcoin or dollars), individual listings are categorised according to a pre-specified classification structure using a rules-based approach through text-matching in the first instance, followed by a long short-term memory (LSTM) artificial neural network (target predictive percentage 90%) that has been trained on historically categorised listings for those not matched through the former process (see methods for full details).

An accompanying public online interactive data visualisation is available, allowing viewers to interact with data collected over the total monitoring period. Data presented here comprise number of listings and number of vendors observed in a given week (see Panel A). These data can be considered reasonable estimates for trends in drug availability, as we cannot guarantee immediate identification and capture of cryptomarkets once they emerge. Further, data provided here can only be used as a proxy of drug availability on cryptomarkets: we have not translated to any metric that reflects the sale volume of a market or specific drug. See here for further discussion of caveats to interpretation.

There are various approaches to collecting, collating, categorising and analysing cryptomarket data, and inherent challenges in these processes. For this reason, we have attempted to be as transparent as possible about our procedures. Our monitoring is an ongoing process, requiring constant refinements to the various stages. We welcome feedback and suggestions so that we can continue to improve utility of these data and our reporting on them (drugtrends@unsw.edu.au).

Findings

Profile of markets

The current bulletin reports findings for the time period 1 May 2019 to 31 May 2020. In that period, 11 cryptomarkets were monitored (Figure 1). Of these, five markets were closed for the following purported reasons (internet sources hyperlinked on market name).

- CGMC – Due to market issues in undertaking withdrawals, CGMC ended operations on 2 May 2019.

- Berlusconi – An Italian law enforcement operation resulted in the shutdown of the market on 26 September 2019.

- Tochka – Due to an exit scam, Tochka shutdown on 24 October 2019.

- Cryptonia Market – For reasons unknown to the authors, Cryptonia Market ceased operations on 14 November 2019.

- Apollon - Due to an exit scam, Apollon ended operations on 23 January 2020.

One of the biggest markets in terms of number of listings, Dream Market, was closed in March 2019, prior to the current reporting period. An additional market, Nightmare, was identified in this reporting period but we were unable to monitor manually or via establishing scripts for automated scripts. Nightmare was closed on 26 July 2019 due to an exit scam.

Three markets which have been operational throughout the period (White House Market, DarkBay and Empire Market) were temporarily unavailable in the last week of May. We have since observed these markets as operational in the following weeks in June 2020 and thus considered them as ‘open’ at the end of the monitoring period. However, two of these markets, Empire Market and DarkBay, have been observed to have shut down post May 2020 which will be discussed in the upcoming bulletin covering the period up to September 2020.

Figure 1. Markets monitored from 1 May 2019 to 31 May 2020

Note: Complete interactive visualisation available here. Shaded area displays the total number of drug listing across all markets monitored at a given time. Caveats to this metric are outlined in the methods. Dashed lines indicate interpolated data over periods where a market could not be monitored. Note that the commencement and discontinuation of the coloured lines indicates the opening and closure of the named market. The black vertical line indicates the date when the World Health Organization declared COVID-19 a Public Health Emergency of International Concern.

A number of markets increased their number of listings during this period, including Apollon Market. Apollon hosted 24,755 drug listings on the 23 January 2020 before its closure on 28 January 2020, an increase from 4,759 listings (or of 420%) since monitoring of this market commenced on the 26 September 2019.

Another market that grew during this period was DarkBay. When first scraped on 2 January 2020, DarkBay hosted 4,053 drug listings. The number of listings subsequently grew by 566% to 27,007 listings on 21 May 2020. There was a particular sharp increase in listings observed when scraped on the 30 April 2020 versus the 7 of May 2020 (see Figure 2), with a three-fold increase from 7,470 to 19,738 listings, respectively. However, the number of vendors on DarkBay remained nearly the same (291 vendors on 30 April 2020 and 301 vendors on 7 of May 2020, as observed in the interactive visualisation).

Another market of note is White House Market, showing steady growth with minimal downtime. This market has been operational from 9 January 2020, with an increase in number of drug listings from 2,400 on that first scrape, to 9,045 listings when last observed on 21 May 2020.

Overall, there was a weekly average of 66,099 drug listings observed across all the markets in the final month of monitoring (May 2020). This was a 23% increase in the number of average weekly listings relative to April 2020 (average of 53,670 listings per week). This could be largely attributed to the sharp increase in drug listings from DarkBay, alongside other market expansions in that month (see Figure 2). It is also important to note a dramatic fall in the number of drug listings following the closure of Dream Market in March 2019, with the period of monitoring indicating potential recovery to account for the loss of this market (see interactive timeline).

Relative to the same month in the year prior, May 2020 saw a 121% increase in average weekly listings as compared to May 2019, with the latter having 29,897 average weekly listings across five cryptomarkets. Please note, however, that the increase in number of listings in month of May 2020 is likely to be higher because we did not interpolate the number of listings of markets that could not be scrapped in the last couple of weeks.

Substance availability

Market listings captured through cryptomarket monitoring have been categorised into drug classes according to this methodology.

Cannabis comprised the bulk of the listings identified across all markets over the total period of monitoring (30%), followed by MDMA (13%), cocaine (8.5%), benzodiazepines (7.0%), meth/amphetamine (6.2%) and opioids (excluding heroin; 5.9%) (see Table 1, Figure 3 and Figure 4). As evident from these figures, illicit substances (e.g., cannabis, MDMA, cocaine, meth/amphetamine) comprised the majority of substances listed on cryptomarkets. New psychoactive substances comprised 4.0% of listings, although challenges in their categorisation must be noted (see methods for further detail).

Figure 3. Percentage breakdown of listings by drug class over time from 1 May 2019 to 31 May 2020

Note: Complete interactive visualisation available here. Missing data are interpolated in this figure. See here for information on how interpolated data were computed. The black vertical line indicates the date when the World Health Organization declared COVID-19 a Public Health Emergency of International Concern.

In terms of change in the percentage of drug listings across all markets disaggregated by drug (i.e., the ‘market share’ for each drug), there was <2% difference in the market share for each drug class across all markets when comparing the percentage of all listings observed in the months April 2020 versus May 2020 (greatest magnitude was a 1.5% increase in listings involving opioids).

There was <5% market share percentage change for each drug across all markets when comparing the percentage of all listings observed in May 2019 and May 2020 (greatest magnitude -4.7% decline in cannabis market share). However, it is important to note that the cannabis share increased to 95% in the last week of May, attributed to a number of major markets being temporarily unavailable.

Figure 4. Number of listing disaggregated by drug for all markets from 1 May 2019 to 31 May 2020

Note: Missing data are interpolated in this figure. See here for information on how interpolated data were computed. MDA, tobacco, paraphernalia, e-cigarettes, PCP, inhalants and alcohol have not been included in the figure. To view these data see our interactive visualisation. The black vertical line indicates the date when the World Health Organization declared COVID-19 a Public Health Emergency of International Concern.

From the month of April 2020 to May 2020, there was an increase in the absolute number of listings per drug across all markets (i.e., the ‘relative market size change’) for the majority of the drug categories, with a few exceptions. The most notable changes in this period were observed in the listings for psychostimulants and nootropics (75% increase to 2,532 average listings per scrape), hallucinogenic mushrooms (70% increase to 944 average listings per scrape), opioids excluding heroin (52% increase to 4,471 average listings per scrape) and cocaine (51% increase to 7,360 average listings per scrape) (see Table 1). As mentioned in the earlier section, this month on month increase could be largely attributed to the sharp increase in listings for the Dark Bay Market and a minor increase in White House Market for the month of May 2020 over April 2020.

In terms of relative market size change from the month of May 2019 to May 2020, most categories had increased due to an overall threefold increase in drug listings. However, there were notably large increases in some categories, namely: cocaine (224% increase in average number of listings to 7,360 in May 2020), ketamine (251% increase in average number of listings to 3,530 in May 2020). Please note, however, that the relative increase in number of listings in month of May 2020 is likely to be higher because we did not interpolate the number of listings of markets that could not be scrapped in the last couple of weeks.

Figure 5 shows the breakdown of listings by drug type per market. These analyses show that most markets monitored listed an array of different drugs, although listings for two markets (CGMC and Cannazon) comprised >90% cannabis. There was also variability in the market share attributed to each drug across markets. For example, DarkBay and Tochka had a greater market share of opioid listings relative to other markets, while Dark Market had the greatest share of MDMA listings relative to other markets.

Figure 5. Drug composition of markets monitored from 1 May 2019 to 31 May 2020

Note: See Figure 1 and our interactive timeline for the duration of monitoring each market. This figure displays drug class percentage of all listings observed from 1 May 2019 to 31 May 2020) for each marketplace monitored. Missing data are interpolated in this figure. See here for information on how interpolated data were computed. Cannazon and CGMC are cannabis-specific cryptomarkets.

Table 1. Breakdown of total listings by drug class from 1 May 2019 to 31 May 2020

|

Drug Category |

Percentage of Total (%) a |

Market Share Percent Change (%) b |

Market Size c |

Relative Market Size change (%) d |

|||

|

May 2019 to May 2020 |

May 2020 |

Apr 2020 to May 2020 |

May 2019 to May 2020 |

May 2020 |

Apr 2020 to May 2020 |

May 2019 to May 2020 |

|

|

Benzodiazepines |

7.0 |

6.8 |

0.4 |

-1.9 |

4,369 |

26 |

68 |

|

Cannabis |

30 |

25 |

-1.1 |

-5.0 |

16,240 |

14 |

80 |

|

Cocaine |

8.5 |

9.9 |

0.8 |

2.3 |

7,360 |

51 |

224 |

|

DMT |

1.2 |

1.3 |

0.1 |

0.1 |

857 |

27 |

133 |

|

GHB/GBL/1,4-BD |

0.4 |

0.3 |

<0.05 |

0.1 |

218 |

6.2 |

167 |

|

Hallucinogenic mushroom |

1.2 |

1.5 |

0.4 |

0.3 |

944 |

70 |

168 |

|

Heroin |

3.0 |

3.1 |

-0.2 |

0.1 |

2,314 |

30 |

161 |

|

Ketamine |

4.2 |

4.7 |

-0.1 |

1.4 |

3,530 |

37 |

251 |

|

LSD |

4.5 |

5.3 |

0.4 |

0.8 |

3,369 |

28 |

154 |

|

MDMA |

13 |

14 |

-1.0 |

1.0 |

8,897 |

15 |

136 |

|

Meth/ amphetamine (illicit) |

6.2 |

6.2 |

-1.0 |

0.7 |

3,953 |

2.6 |

139 |

|

New psychoactive substances |

4.0 |

3.7 |

-0.4 |

-0.3 |

2,350 |

6.2 |

97 |

|

Opioids (excluding heroin) |

5.9 |

7.0 |

1.5 |

0.7 |

4,471 |

52 |

136 |

|

Other medicines |

3.3 |

2.5 |

-0.5 |

-1.2 |

1,615 |

-0.8 |

46 |

|

PIEDs/ weight loss |

4.3 |

3.4 |

-0.8 |

-0.5 |

2,525 |

11 |

120 |

|

Psychostimulants & nootropics |

2.9 |

4.0 |

1.3 |

1.0 |

2,532 |

75 |

186 |

Note: Alcohol, e-cigarettes, Paraphernalia, tobacco and inhalants, PCP, MDA and Other Drugs not shown in this table due to small values. – Per cent suppressed for values <0.05. All values in table have been calculated using interpolated data. See here for information on how interpolated data were computed. a This column displays the percentage of total listings across all marketplaces observed in the month of May 2020. b These columns display the change in percentage of total listings attributed to each drug across all marketplaces in the stated months (e.g., from May in one year to May in the next year). c This column displays the average number of weekly listings observed across all marketplaces in the month of May 2020. d These columns display the relative change in the average number of weekly listings observed in the stated months (e.g., from May in one year to May in the next year). Each column is colour coded to highlight the highest numbers in green, the average numbers in amber and lowest numbers in red, following the colour scale. PIEDS: performance and image enhancing drugs.

Impacts of COVID-19 and associated restrictions on cryptomarkets

Figure 6. Total number of drug listings by marketplace from 1 May 2018 to 31 May 2020 and number of COVID-19 cases (worldwide)

Note: The monitoring for the number of new COVID-19 started on 31 December 2019. As we have plotted the seven day moving average, the first data point is on 3 January 2020 which shows the mean number of cases per day from 31 December 2019 to 6 January 2020.

Figure 6 shows the time series for number of drug listings mapped against a key indicator of the COVID-19 pandemic; namely, the number of new cases globally since the start of monitoring on 31 December 2019. This figure would suggest some recent growth in markets in terms of number of listings since the impacts of the COVID-19 pandemic have unfolded, particularly in the month of May. However, there has been a general trend of increasing drug listings since April 2019: this follows a substantial decline in listings with closure of the largest marketplace we have ever monitored, Dream Market, in March 2019. Ongoing monitoring will be important to further elucidate changes in drug cryptomarkets alongside the evolution of the COVID-19 pandemic.

For the interested reader, we highlight recent findings from the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA) showed increased trade across three marketplaces in February and March 2020, with other research has shown showing an increase in unsuccessful transactions on cryptomarkets in April 2020.